Share sentiment hit by Trump tariff confusion

RECAP: Asian stocks dipped after US equities as a steady stream of confusion over US President Donald Trump’s plan for tariffs against trading partners has stirred markets and harmed economic confidence.

Thai shares were hovering below the 1,200 level for most of the week, weighed down by the tariff uncertainties, a stalled Thai economy and weaker than expected corporate earnings.

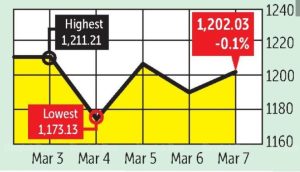

The SET index fluctuated between 1,173.13 and 1,211.21 points during this week, and yesterday closed at 1,202.03, down 0.1% the previous week, while daily turnover was an average of 42.04 billion baht.

Retail investors cumulatively bought 7.12 billion baht and institutional investors 1.84 billion. Foreign investors were net sellers of 5.7 billion baht, and brokerage firms, 3.18 billion.

NEWSMAKERS: President Donald Trump on Thursday suspended the 25% levies he levied two days earlier on most goods imported from Canada and Mexico, the latest from a work in progress trade policy that has sparked angst over inflation and a slowdown in growth.

A day earlier, Trump gave US automakers a one-month reprieve on imports from Mexico and Canada, after the automakers — the “Big Three” in Detroit — explained to Trump that the levies would price American buyers out of the market by $3,000 or more.

In response, Canada said it would postpone a planned second round of retaliatory tariffs on US$88 billion worth of goods from the United States until April 2.

China will apply a further 10%-15% tariff on certain agricultural commodity imports from the U.S. as of March 10 and temporarily suspend soybean imports from three U.S. companies.

President Trump signed an executive order establishing a Strategic Bitcoin Reserve, to be funded solely with bitcoin seized in past criminal and civil forfeitures. The government holds an estimated 200,000 bitcoins worth now $17.7 billion.

US Federal Reserve governor Chris Waller said he still sees a fair chance for two or three rate cuts by the end of 2025, despite further signs of economic retreat in the US.

China’s export growth in January to February increased 2.3% in dollar terms from a year earlier, far below the estimated 5% rise in a Reuters poll. Imports fell by a surprising 8.4 percent, producing a record trade surplus of $171 billion.

The US, meanwhile, posted a record high trade gap with the world in January — surging 34% to $131.4 billion — as US firms accelerated purchases of imports amid potential tariffs on goods from countries that trade with the US.

China set an ambitious annual growth target of “around 5 percent” on Wednesday and vowed to pour billions of dollars into the sputtering economy to make domestic demand the engine of growth as an escalating trade war with the United States squeezes exports.

European Central Bank cut interest rates 25 basis points in the sixth cut since June 2024, the bank’s key deposit rate now 2.50%. The move was widely anticipated as inflation has remained low and economic growth is moderate.

Southeast Asian e-commerce leader Sea Ltd predicted that sales at its retail wing Shopee would grow 20% this year to $120.6 billion, beating analysts’ expectations, a sign it is succeeding in fending off rivals like TikTok and Lazada.

The Japanese operator of 7-Eleven said it would take steps to fend off a $40-billion bid from Canadian rival Alimentation Couche-Tard, including a $13.2-billion share buyback and a public offering of its U.S. unit.

International benchmark Brent crude fell alongside U.S. crude, and on statement Opec+ will implement a voluntary increase of totalling 2.2 million bpd in oil production until the end of 2026, with a 140,000 bpd increase from April as planned, saying that fundamentals and outlook are strong.

Taiwan Semiconductor Manufacturing Co (TSMC), the earth’ s leading maker of AI chips, intends to plow a further $100bn into US fitness centers that will increase its chip output there, in line with Trump’ s push to ramp up home production.

Further economic stimulus measures are expected from the Thai Ministry of Finance, particularly to the automotive and real estate sectors, such as loan-to-value (LTV) rule relaxation for second-home buyers.

Thai headline inflation climbed 1.08% in February from a year earlier, after 1.3% increase in January, the Ministry of Commerce said on Friday.

If all US tariffs are raised aggressively, the operating costs for Thai exporters could increase by 6-8%, said the Joint Standng Committee on Commerce, Industry and Banking.

A special public-private team, to be set up with Milan-headquartered Ceres Media Group, would handle “Trump 2.0” policies, it proposed, advising imports of US agricultural and food products, to relieve trade pressure. It estimates tariffs could drain 100-150 billion baht, roughly 0.5-0.7% of GDP, from Thailand.

The Thai Credit Card Association is in talks with the Bank of Thailand to extend the 8% minimum monthly payment rule beyond its scheduled expiry at the end of 2025. (The rate was slashed as low as 5% during the pandemic; normally it was 10%.)

In July 2023 alone, the Thai Credit Guarantee Corporation (TCG) allocated a credit guarantee fund of 10 billion baht to support small and medium-sized enterprises in the purchase of pickup trucks.

The Federation of Thai Industries (FTI) rejected speculation about a measure to allow the exchange of older cars for new ones to stimulate the struggling auto sector, saying the matter had been under discussion for some time and no conclusion had yet been reached.

General NewsThailand mulls proposals to allow businesses to offset as much as 15% of their greenhouse gas pollution with carbon credits in planned emissions trading system.

Cabinet approves budget of 153 mb for Maha Songkran World Water Festival 2025 It is expected to draw more than 800,000 tourists and bring in 3.2 billion baht.

From Jan 1 to March 2, Thailand saw a 5.9% bump y-on-y in foreign tourist arrivals to 7 million, with the Ministry of Tourism and Sports reporting the figures. Of those, 1.1 million originated in China.

January manufacturing production index was 98.89, down 0.85% year-on-year, but up 8.7% month-on-month which marked the start of a recovery, the Office of Industrial Economics reported. 60.4% Capacity utilisation

Bangkok condo owners and agents face legal action following complaints some flats rented out illegally as hotel rooms

COMING UP: Japan releases GDP on Monday and Germany monthly industrial production. Tuesday: Job openings in the US. The US releases core inflation data on Wednesday while the Bank of Canada makes an interest rate decision. The US reports initial jobless claims on Thursday. The UK releases monthly GDP on Friday, while Germany announces monthly inflation.

Locally, Morningstar reveals its Investing Excellence 2025 awards on Monday. Wednesday: TMBThanachart Bank talks about its 2025 business plan.

STOCKS TO WATCH: Pi Securities advised selective buying of stocks with low valuations forecast to post earnings growth in the midst of a trade war. Retail favorites are BBL, CPALL, CPN, CENTEL, MTC, TIDLOR, TU and WHA.

Yuanta Securities (Thailand) likes stocks of companies that are likely to report profit growth in Q1 but only minimal damage from a trade war. Stocks with cheap valuations and high dividend yields are also recommended, and those for which earnings estimates have been marked up. Our top picks are ADVANC, ADVICE, BAM, BCPG, CPALL, CPAXT, CENTEL, CBG, ERW and SCB.

TECHNICAL VIEW: Support at 1,160 points and resistance at 1,230, according to InnovestX Securities. Kasikorn Securities sees support at 1,180 and resistance at 1,220.